No flexibility in stadium build revenue to the CountyIf Spoty were to partner with baseball - all of the projected tax revenue (risky to start with) from the proposed site and surrounding area - would have to be spent by Spotsylvania on the debt service for the baseball stadium. There is of course a large amount of risk that the deal would not generate enough tax revenue to pay for the debt service - meaning other funds would have to be diverted to do so . . .

BUT - the key point here is that future tax revenue to Spotsylvania that is flexible as to where it may be spent to support (Schools, Fire, Rescue, EMS, Sherriff) would be transferred into being inflexible by a required debt service payment on the stadium and parking garage. This hurts Spotsy and makes our future leader's jobs much harder. It increases the probability of a future property tax rate increase as compared to the equalized rate and is just bad business. In personal terms – (this is to scale), the deal would be like me offering to build a restaurant with parking for a friend to cost me $500,000. My friend would give me 80,000 and in return I would give my friend all revenues from food and t-shirt sales, all parking charges, I would cut the grass and provide part time maintenance person, I would provide ambulance and Sherriff vehicles and if romantic dinners, a firetruck to cover the romantic fireworks. In return my friend would pay me $1,500 per year (not per month) rent for the next 25 years. No thanks.

|

Issue - Taxpayers should not have to pay for private baseball stadiumI love baseball! I played a little as both short stop and pitcher in high school and have coached a youth baseball team for the past 9 years. I would love minor league baseball to come to Spotsylvania County – just not at taxpayer expense.

I believe a partnership with a minor league baseball team – is far outside the scope of what government and your taxes should be involved in. Please scroll down to “Outside Scope of Government” for more. If one does brave jumping over the role of government hurdle – the next issue with public funding of baseball is the “deal”. Minor league baseball is used to deals that none of us would ever enter into, if it were our own money. Below I’ve provided the link to all the source information (***see Source information link below), but to recap the May 5th, 2015 “deal” with a total value of $50M. The team was to give $8M toward the construction of the stadium, $150K in rent / year, and I believe 40K/year in annual maintenance funding. Spotsylvania County was to give $42M in bond funds for building both the baseball stadium and 1,500 space parking garage. Spotsy would provide for the team 4 electronic billboards throughout the County – totally controlled by the team, 2 Sheriff’s vehicles to every game, 1 ambulance to every game, 1 firetruck for every game (undisclosed number) that included fireworks (all free of charge), provide outside landscaping, provide part time maintenance consultant, and provide snow removal in the winter. The team would get all revenues on ticket sales, all advertising on the electronic bill boards, all merchandise and food sales revenue (less any taxes), naming rights to the stadium to which they would sell and get money for, team would set parking garage fee and retain all revenue from the County built parking garage (first deal, second the team would get 75% of parking revenue), and all other items mentioned above in what Spotsy was to give. On the air with ted Schubel about public funding of baseball in spotsy |

*** Source information for all baseball may be found at: http://www.spotsylvania.va.us/highlights/?FeedID=682

or click here

or click here

Outside scope of government-When you think of the services your local government should provide to its residents - I think of Fire, Emergency Medical Service, Security (Sheriff), and Education.

These are services that are difficult for the free market to support while at the same time - clearly benefit all of us. The above is the role of local government. Spotsylvania County leadership (the board of supervisors) has the ability to tax (take money from all property owners) and spend these revenues - with the full authority of the law behind it. Bottom line - if you don't pay your taxes - your house or your car can and will be taken from the Citizen who does not pay his/her taxes. Therefore - the role and scope of the what the government is taxing the Citizen for - should be a very serious factor in your Representative's decision making (how he/she votes on the board) - and should be a key part of the Citizen's decision on who he/she votes for their Representative. I take the proper role of government very seriously. The government has the responsibility to serve the people - it should never be the people serving the government. By imposing a stadium build and up to $42M in debt service for a "sporting" facility - means your local government would force most of our residents to pay for something they don't want. This is not the role of government. |

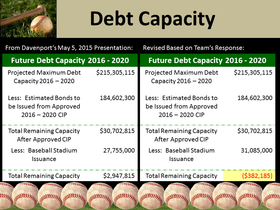

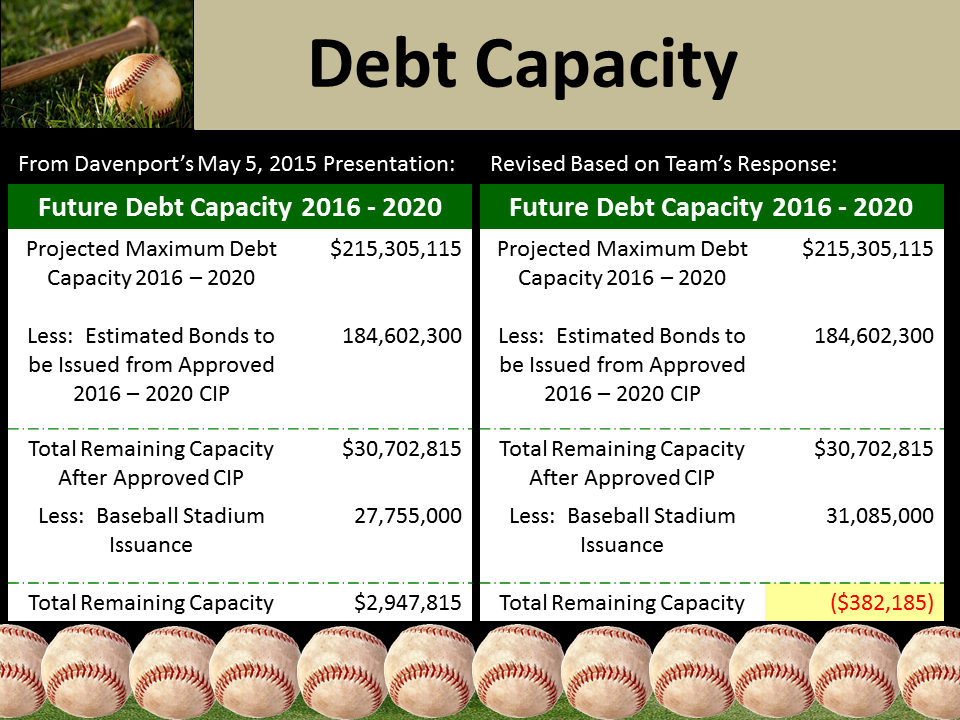

Red-lining our debt capacityPlease click on the picture above to watch a YouTube video of the debt capacity discussion. Also - if you would scroll down - I have put a larger, more readable slide of debt capacity.

Davenport presented on May 5th, 2015 that the County's debt capacity would be maxed out if the County let $42M in additional bonds. On July 14th, 2015 after another offer from the team - we went over redline to negative debt capacity. What this equates to is that if you or I went to a bank and had a list of items, with our income, that we could get a loan for and still stay reasonably solvent - say a home, 2 cars, a motorcycle, a moped, and a chain saw - we would have to go back and cut one or more of these items out - in order to do something similar to the stadium. In Spotsy's case - we would have to look at the Capital Improvements we have already planned such as the Courthouse expansion - and take something off the table to put this on. It is not fiscally responsible to redline your debt capacity - personally - or for the County's leadership to do the same. |

Net Present value calculation - and schools/Fire/SheriffThe free market - is the better market to bring minor league baseball to Spotsylvania - I would love for baseball to come here - just not at taxpayer risk.

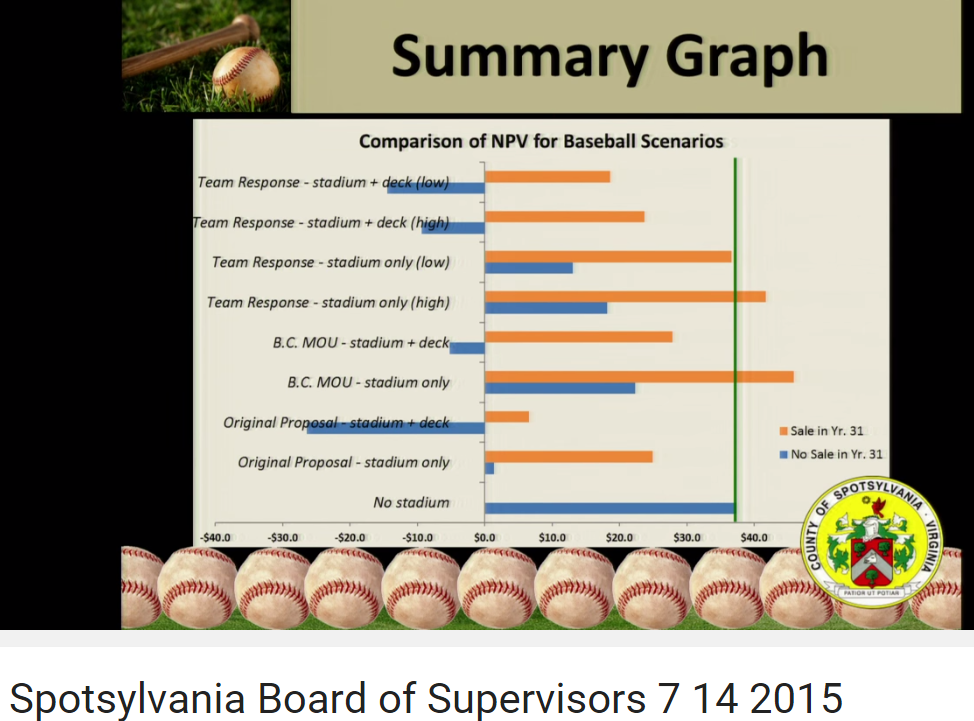

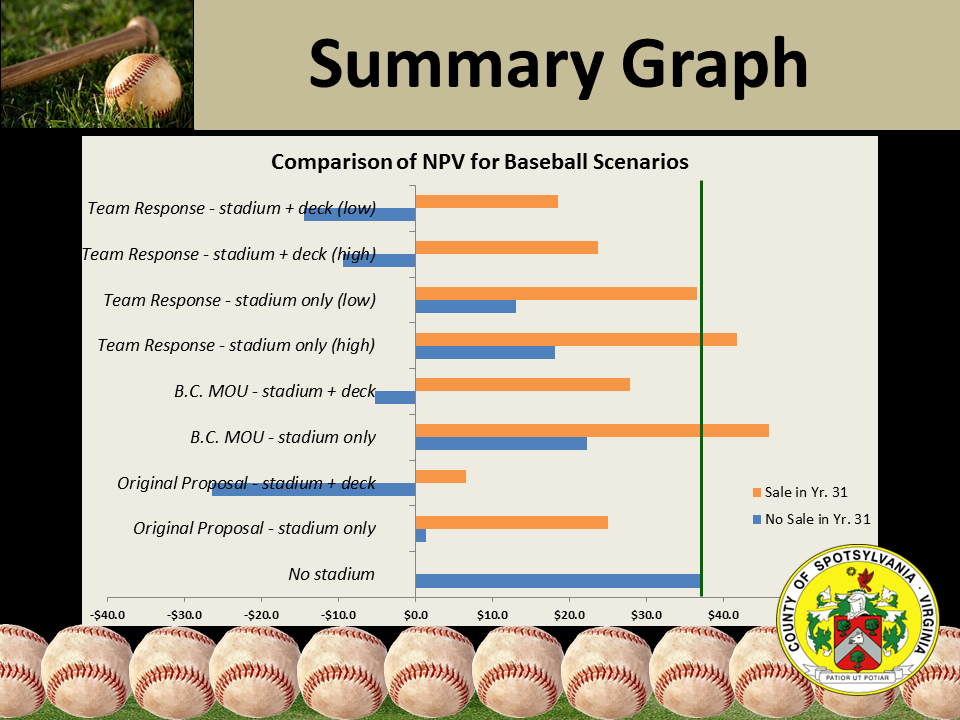

County Staff presented the Net Present Value (NPV) graph (larger graph below - please scroll down to view). NPV is simply what a future cash flow is worth today. Like if you win the lottery - it's the difference between the total dollar amount you won - and the lump sum payment "today". NPV is the "today" amount The bottom row "No Stadium" on the graph shows the value of the real estate tax to the county in today's dollars if no stadium were built - and the land developed out as forecast when it was rezoned to "mixed use" in June of 2014. Of note - all of this revenue (approximately $37M) could be used for schools - but a baseball decision makes it pay the debt service on the stadium (if all goes well - if not - services must be cut or taxes must be raised). Only two scenarios were projected to do better for the County than no build - Both did NOT include the required parking garage, and both assumed a sales price of the Stadium 31 years from now - at a price tag of $50M dollars!!! That was a bit high I think. One more note - The portion of NPV to the County (future revenues) under the stadium build option would be earmarked to pay off the stadium's debt service. This is very important to consider. The "no stadium" revenue can be used for any County need - schools, fire, emergency medical, etc - but the "stadium build" options would require the future cash flows in real estate tax to pay for the debt service on the stadium - taking money away from these other needs/requirements. |

County Staff presented this Net Present Value (NPV) graph. NPV is simply what a future cash flow is worth today. Like if you win the lottery - it's the difference between the total dollar amount you won - and the lump sum payment "today" NPV is the "today" amount

The bottom row "No Stadium" shows the value of the real estate tax to the county in today's dollars if no stadium were built - and the land developed out as forecast when it was rezoned to "mixed use" in June of 2014. Of note - all of this revenue (approximately $37M) could be used for schools.

Only two scenarios were projected to do better for the County - Both did NOT include the required parking garage, and both assumed a sales price of the Stadium 31 years from now - at a price tag of $50M dollars!!! That was a bit high I think.

One more note - The portion of NPV to the County (future revenues) under the stadium build option would be earmarked to pay off the stadium's debt service. This is very important to consider. The "no stadium" revenue can be used for any County need - schools, fire, emergency medical, etc - but the "stadium build" options would require the future cash flows in real estate tax to pay for the debt service on the stadium - taking money away from these other needs/requirements.

paid for and authorized by Ross4Courtland